Additionally, you can track how your investments into ordering new assets have performed year-over-year to see if the decisions paid off or require adjustments going forward.

Regardless of whether the total or fixed ratio is used, the metric does not say much by itself without a point of reference.

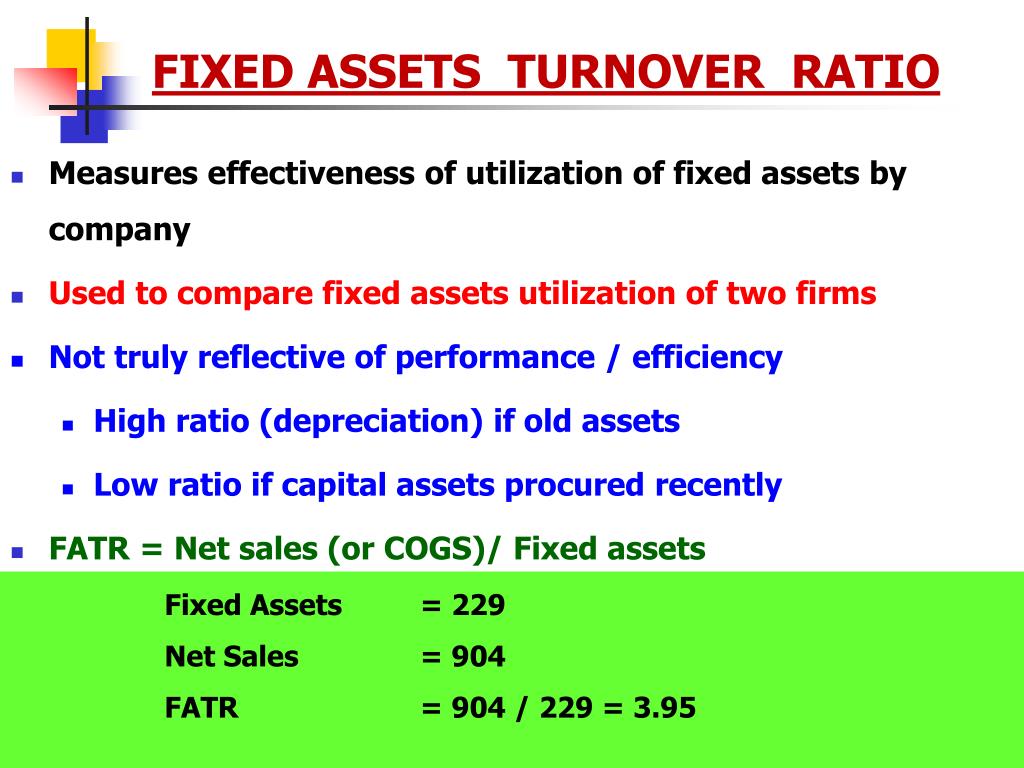

For the final step in listing out our assumptions, the company has a PP&E balance of $85m in Year 0, which is expected to increase by $5m each period and reach $110m by the end of the forecast period. For Year 1, we’ll divide Year 1 sales ($300m) by the average between the Year 0 and Year 1 PP&E balances ($85m and $90m), which comes out to a ratio of 3.4x. Net Sales refers to normal revenue that the company generates from its core operation. There is no exact ratio or range to determine whether or not a company is efficient at generating revenue on such assets. Companies with a higher asset turnover ratio are more effective in using company assets to generate revenue. Sectors like retail and food & beverage have high ratios, while sectors like real estate have lower ratios. Like other ratios, the asset turnover ratio is highly industry-specific. We take a simple average of total assets as at the current period-end and previous period-end. Generally, High Fixed Asset turnover ratio indicates that the company is more efficient since it generates more revenue from each dollar of Fixed Assets. Return on equity is a measure of financial performance calculated by dividing net income by shareholders’ equity. The accounting profit calculator is a simple tool that helps you to compute and understand the profit of a firm or business from an accounting perspective. They measure the return on their purchases using more detailed and specific information. It might also be low because of manufacturing problems like abottleneckin thevalue chainthat held up production during the year and resulted in fewer than anticipated sales. The company’s performance is performing well, and the annual sale for 2016 is USD 50,000,000.Īlso, they might have overestimated the demand for their product and overinvested in machines to produce the products. In other words, this company is generating $1.00 of sales for each dollar invested into all assets. Hence, it is often used as a proxy for how efficiently a company has invested in long-term assets. We now have all the required inputs, so we’ll take the net sales for the current period and divide it by the average asset balance of the prior and current periods.

What Is a Good Fixed Asset Turnover Ratio?.

0 kommentar(er)

0 kommentar(er)