You can lift a credit freeze from your credit file with Equifax by one of the following:

Here are the instructions for each of them. Each of the three main credit reporting agencies have similar procedures for lifting a credit freeze.

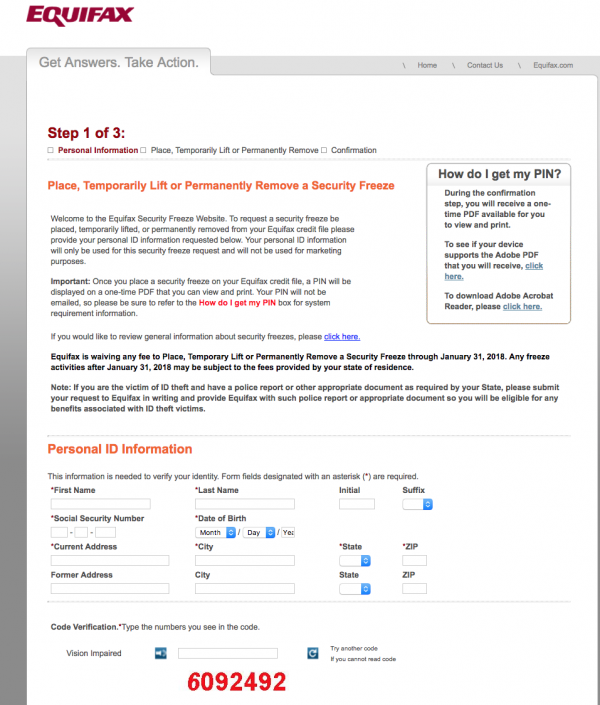

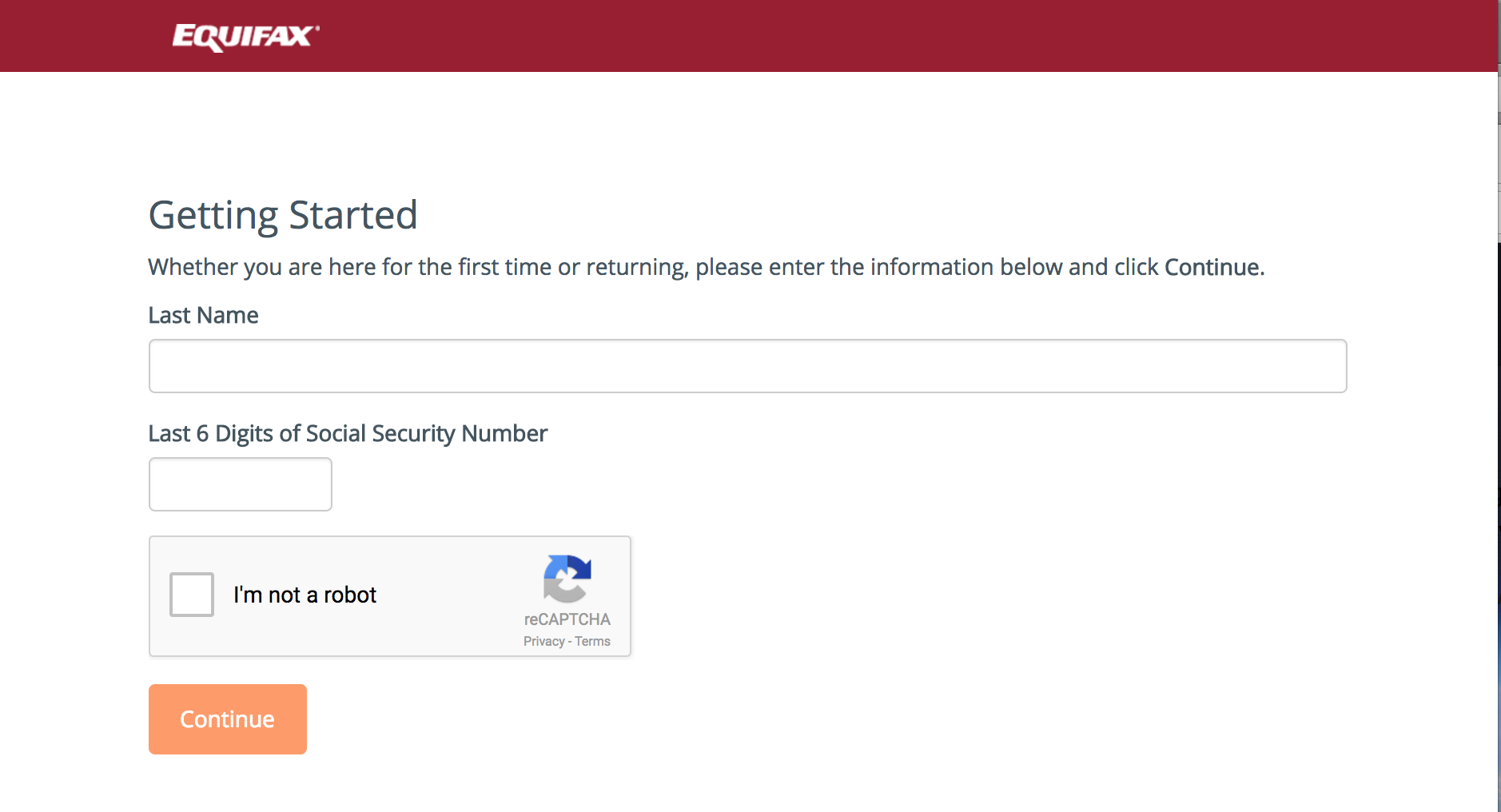

EQUIFAX LIFT FREEZE WITHOUT PIN FREE

Thanks to a new law that went into place in 2018 its now free to place, lift, and remove a security freeze. Once the application is approved, you can reinstate the credit freeze if you deem it necessary.

EQUIFAX LIFT FREEZE WITHOUT PIN FULL

This PIN can be used to temporarily lift or permanently unfreeze (thaw) a credit freeze when a new, legitimate application for credit is submitted.īecause credit decisions cannot be made without a full review of your credit report and history, you may want to lift a credit freeze when you are applying for a new credit card, personal loan, mortgage or line-of-credit. The process of enacting a credit freeze on your credit file involves the creation of a unique personal identification number (PIN) with each of the three major credit bureaus. A credit freeze does not have an impact on your current credit accounts, and it can be permanently removed (thawed, unfrozen) or temporarily lifted when necessary. By placing a credit freeze on each of your credit reports held with the three major credit bureaus TransUnion, Equifax and Experian, new applications for credit cannot be approved because creditors are unable to view your credit report history and score.Ī credit freeze is powerful because even when a criminal gathers your personal information, he or she has no way to use it to open a new credit card account, loan, or other line-of-credit. What is a Credit Freeze?Ī credit freeze, also known as a security freeze, is the process of freezing your credit to provide a barrier between your personal credit file and an identity thief. However, there are tools in place meant to protect you from having your information used for the benefit of someone else, including a security credit freeze. Shopping, banking and applying for credit can all be done online, making it a challenge to fully protect yourself from the malicious intent of identity thieves.

Identity theft has been a growing concern for consumers over the past decade, as more activities become Internet-based.

0 kommentar(er)

0 kommentar(er)